Immerse yourself in the fundamental aspects of intermediate accounting, a critical subject in the field of Business Studies. This thorough examination delves into its concepts, significance, real-life applications, and its critical role in crafting balance sheets and managing cash and receivables. Whether it's tracing the historical develop of this field or offering exemplary cases from actual businesses, this article provides a comprehensive overview. Furthermore, it extends guidance on preparing for exams in this subject, detailing effective study techniques and common pitfalls to avoid. So, prepare to expand your knowledge, glean practical insights, and adopt strategies to excel in intermediate accounting.

What is Intermediate Accounting

Intermediate Accounting refers to the second level of studying accounting in Business Studies. It primarily focuses on the practice and implementation of accounting principles dealing with detailed reporting standards and methods, comprehensive financial statements, and analyses of specific financial operations or conditions.

Understanding the Concept of Intermediate Accounting

Taking a closer look at Intermediate Accounting helps to understand why it earns such an important place in Business Studies. At its core, Intermediate Accounting concerns itself with the finer aspects of business transactions, as well as the preparation and analysis of financial statements.

For instance, you may encounter a scenario where a business needs to account for an elaborate lease agreement. Traditional introductory accounting might only go so far as to explore the basic leasing concepts. However, Intermediate Accounting will delve into the intricacies of how to record, report, and analyse these transaction over the full duration of the lease period.

Intermediate Accounting handles a variety of complex topics, such as:

Tracing the Historical Development of Intermediate Accounting

Understanding the evolution of Intermediate Accounting offers valuable insights into the progression and sophistication of today's accounting practices. The discipline has been discernibly shaped by economic and business developments, legislation, advancement in technology, and the complexity of modern business transactions.

| 19th Century |

Modern accounting principles emerged, driven by the rise of the industrial age and growth of corporations. |

| Early 20th Century |

The establishment of accounting bodies contributed to the formalization and standardization of accounting practices. |

| 1950s–1980s |

The information age brought about advancements in accounting systems and procedures. |

Significance and Role in Business Studies

Intermediate Accounting plays a crucial role in a business' fiscal health; this level of expertise helps to maintain transparency, facilitates strategic decision-making, and ensures compliance with laws and regulations.

Moreover, it provides a vital link between introductory accounting and advanced financial accounting. By providing a more profound understanding of accounting principles, it elevates students' analytical skills and prepares them for more advanced and specialised study areas like auditing, tax, and management accounting.

These are the essential roles of Intermediate Accounting:

Ensuring financial transparency by adhering to standard accounting principles when reporting business transactions

Facilitating strategic decision-making by providing detailed financial insights

Guaranteeing compliance with relevant laws and regulations by following appropriate accounting practices

Intermediate Accounting Examples

In practically every business context, you'll find formidable cases that benefit from a deep dive into Intermediate Accounting. By exploring detailed examples and case studies, you can caliberate your understanding and recognise its application in real-world business scenarios.

Illustrative Examples of Intermediate Accounting

Some clear examples of the topics covered in Intermediate Accounting include the forecast of future cash flows and the proper accounting treatment for pensions.

For instance, consider a case where a business has a major machine that got damaged. According to the traditional accounting rules, if the machine can no longer render any form of economic benefits, it is declared worthless. However, in Intermediate Accounting, attention is paid to elements of

value impairment and concepts of

depreciation. The machine might still have some residue value left or could potentially serve another use.

Consider a second scenario which involves

pensions. In the most basic accounting setups,

pension costs are recorded in the year they are paid. On the contrary, Intermediate Accounting focuses on

accrual accounting, recognising

pension costs in the period employees earn them, regardless of when they're paid.

Assume, for example, that a group of employees earn

pension benefits in 2020 for services rendered, though the actual

pension payments wouldn't occur until 2030. Under accrual accounting, these

pension costs would be recognised in 2020 itself, even though the cash wouldn't be paid out until a decade later.

This approach aligns with the matching principle in accounting, which states that expenses should be reported in the same period as the associated revenues.

Comprehensive Case Studies in Intermediate Accounting

An interesting case study here from the realm of Intermediate Accounting involves taking a nuanced look at the

Revenue Recognition Principle. Here, the recognition of revenue isn't as straightforward as it looks.

Assume there's a large tech corporation that sells multi-year software licenses. Payments for these licences might be received immediately, but according to the revenue recognition principle, the company needs to recognise this revenue over the course of the software license contract and not all at once.

This complex situation is the ideal example of where Intermediate Accounting steps in, breaking down the revenue to be recognised each year according to the formula

\[ \text{{Yearly Revenue}} = \frac{{\text{{Total Revenue}}}}{{\text{{License Duration (Years)}}}} \]

This Intermediate Accounting approach showcases the depth of insight needed to accurately record and analyse complicated business transactions.

How Intermediate Accounting is Used in Real Business Scenarios

Intermediate Accounting comes into play regularly in real business scenarios.

For example, imagine a retail company that deals with customer returns. Intermediate Accounting helps decipher how these returns should be recorded and reported. You'd need to account for the potentially returned merchandise in the financial statements, even though that income was initially recognised.

Finally, consider the application of Intermediate Accounting in a rapidly growing start-up. The start-up may have to analyse and decide whether to lease or buy a necessary high-value equipment. This decision would shape their future financial commitments and cash flow projections, requiring a deep understanding of the principles learnt in Intermediate Accounting, such as

capital lease versus

operational lease implications, present value calculations and understanding of lease agreement specifics.

Balance Sheet Intermediate Accounting

One of the key aspects you'll encounter in Intermediate Accounting is the balance sheet. It's a financial statement that provides a snapshot of a company's financial condition by presenting its assets, liabilities, and shareholders' equity at a specific point in time. Accurate preparation and in-depth analysis of balance sheets are key skills honed in intermediate-level accounting.

Role of Balance Sheets in Intermediate Accounting

In Intermediate Accounting, the balance sheet is more than a simple statement—it's a tool for peering into a company's financial health and operational efficiency. By limiting the balance sheet to raw numbers, you miss out on deep analyses such as understanding the ratios of debt to equity, realising the rate of inventory turnover, or analysing the accounts receivable turnover ratio.

These insights from balance sheets aid in making predictions, generating comparisons across different periods, and making informed strategic decisions for the business. This application of accounting theory to the realistic business landscape sets Intermediate Accounting apart from basic accounting.

As an Intermediate Accounting student, you'll learn to grapple with elements like

contingent liabilities or the implications of a changed

inventory valuation method. You'll understand the differences between

current and non-current assets or liabilities and when to rightly recognise revenue or delay it. These complexities are where intermediate expertise is needed and lend the balance sheet its real value.

Breaking Down the Elements of Balance Sheets

A solid understanding of the elements contained in a balance sheet is vital for Intermediate Accounting. A balance sheet, adhering to the fundamental accounting equation \( \text{{Assets}} = \text{{Liabilities}} + \text{{Shareholders' Equity}} \), is divided into three main sections:

Assets: Resources owned by a company that provide economic benefits

Liabilities: Obligations the company owes to others

Shareholders' Equity: Represents the net value of the company, calculated as Assets minus Liabilities.

Each of these sections can be broken down further. For example, you can segregate Assets into

current assets (likely to be converted into cash within one year, such as cash, inventory, and accounts receivable) and

non-current assets (assets likely to provide benefits for more than one year, like property, plant, or equipment).

Similarly, liabilities are divided into

current liabilities (obligations expected to be paid off within one year, like

accounts payable or short-term debt) and

non-current liabilities (debts or obligations not due within one year, including long-term loans or deferred tax liabilities).

Application of Intermediate Accounting Techniques in Preparing Balance Sheets

Preparing balance sheets entails more than inputting debits and credits. In Intermediate Accounting, you're required to apply several accounting principles and techniques to present an accurate picture of a company's financial standing.

For example, consider deferred tax liabilities. These occur when a business reports lower income for tax purposes than for

financial reporting on the balance sheet because of the differences in the accounting rules for determining taxable profit and accounting results. You need to calculate and record deferred tax liabilities for making the balance sheet comprehensive.

Another application of Intermediate Accounting in preparing balance sheets involves underlining the importance of the materiality concept. It suggests that only items with significant economic impact should be separately presented. An analysis of the balance sheet should consider this principle, thus ensuring that attention is focused on matters with more substantial financial impact.

Ultimately, the preparation of a balance sheet in the realm of Intermediate Accounting involves judgements,

estimates, and assumptions. It underscores the need for students to appreciate the art behind the science of accounting. Your ability to make wise judgement calls in determining the classification, valuation, and presentation of balance sheet items is a testament to your success in Intermediate Accounting.

Cash and Receivables Intermediate Accounting

In the world of Intermediate Accounting,

cash and receivables carry great importance. This area concerns understanding how to accurately present cash, cash equivalents and receivables on a company's balance sheet while conforming to the common standard accounting principles. It extends beyond mere calculations, encapsulating the recognition, measurement, and disclosure of cash, cash equivalents, and various forms of receivables.

Understanding Cash and Receivables in Intermediate Accounting

In Intermediate Accounting,

cash refers to money readily available for use like coins, currencies, and available balances in bank accounts. It also encompasses items that can be quickly converted into cash, known as

cash equivalents. These include short-term, highly liquid investments with maturities that typically do not exceed three months at the time of acquisition, such as treasury bills, commercial paper, and money market funds.

On the other hand,

receivables are monetary claims against others, including vendors or customers. They typically result from the sale of goods or services and are sometimes referred to as accounts receivable. There is also

notes receivable, which involve a written promise to pay a certain amount of money at a specified future date.

As part of Intermediate Accounting, you learn various techniques to account for uncollectible receivables, such as the

direct write-off method and the

allowance method. The direct write-off method is straightforward, enabling the company to write off specific receivables deemed uncollectible. The allowance method, meanwhile, is more complex, as it requires estimation of uncollectible amounts based on historical patterns or industry averages.

Impact of Cash and Receivables on Financial Statements

The representation of cash and receivables in the financial statements is crucial as it significantly impacts a company's liquidity position and overall financial standing. In the balance sheet,

cash and cash equivalents appear as part of the current assets, while receivables could appear either as current or non-current assets, depending on the estimated time of collection.

Efficient management of cash and receivables is essential for maintaining positive cash flow and ensuring short-term operational needs, affecting a firm's liquidity ratio as viewed by investors and analysts. Additionally, receivables make up a significant portion of total assets in various industries, especially in the services sector. Thus, their accurate representation directly impacts the resulting metrics of asset management, such as receivable turnover and collection periods.

In Intermediate Accounting, you'll delve deeper into the understanding of how delays in receivable collections, aging receivables, or high proportion of uncollectible receivables significantly impact a company's profitability and sustainability, shaping the stakeholders' perception of the company's risk and return.

Methods and Techniques for Cash and Receivables Accounting

Intermediate Accounting takes you a step further from merely recording transactions to mastering critical methods and techniques for cash and receivables accounting. For instance, in handling uncollectible accounts receivable, the

percentage-of-sales method or the

aging-of-accounts-receivable method under the allowance method are typically used. These techniques involve a degree of estimation, enabling companies to match revenues with the corresponding expenses effectively.

In valuing receivables, Intermediate Accounting introduces concepts like the

net realisable value — the estimated selling price in the ordinary course of business, less reasonably predictable costs of completion and disposal, and the

fair value — the price that would be received to sell an asset in an orderly transaction between market participants at the measurement date.

Intermediate Accounting also probes into robust measures when dealing with notes receivables, including discounting or valuing them. A common technique involves computing the present value of

notes receivable using the formula

\[

\text{{Present Value}} = \text{{Future Value}} / (1 + \text{{Interest Rate}})^{\text{{Time}}}

\]

Comprehensive understanding of these methods and techniques ensures precision when you're accounting for cash and receivables, consequently providing faithful and relevant financial information. By the end of your course in Intermediate Accounting, you'll be able to fully appreciate the dynamics of managing a company's most liquid assets — cash and receivables.

How to Pass Intermediate Accounting

Passing Intermediate Accounting isn't simply about rote learning – it involves understanding precise accounting principles, staying updated with regular legislative changes, and applying your theoretical knowledge wisely across a multitude of complex business scenarios.

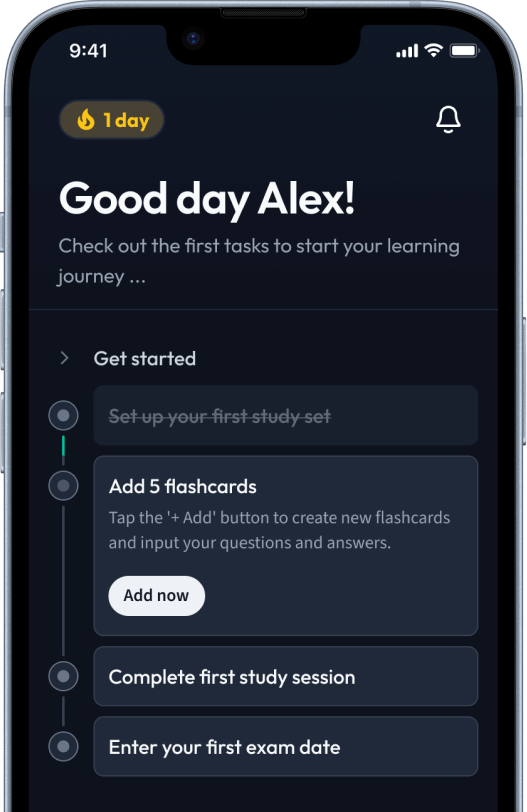

Strategies for Acing Intermediate Accounting

Strategic planning, disciplined preparation, and a deep understanding of accounting practices are paramount for excelling in Intermediate Accounting. With diverse topics spanning from revenue recognition to balance sheet preparation, mastering Intermediate Accounting requires focused efforts.

Firstly, a structured

study plan can guide your preparation. Make a comprehensive timetable, incorporating manageable targets throughout the week. Break down the syllabus, and allocate ample revision time.

Understand the syllabus thoroughly, identifying the compulsory and optional modules, and their weightage.

Emphasise on understanding core concepts, as all advanced topics emerge from these basic principles.

Keep track of your progress with periodic self-assessment.

Another powerful tactic is leveraging

problem-solving. Problems and case studies provide practical exposure, helping you understand intricacies and unique scenarios that can’t be gleaned from theory alone.

Lastly, always stay

updated about the constant changes in accounting standards and principles. A reliable source of updates is your local accounting body website, or newsletters from international accounting organisations.

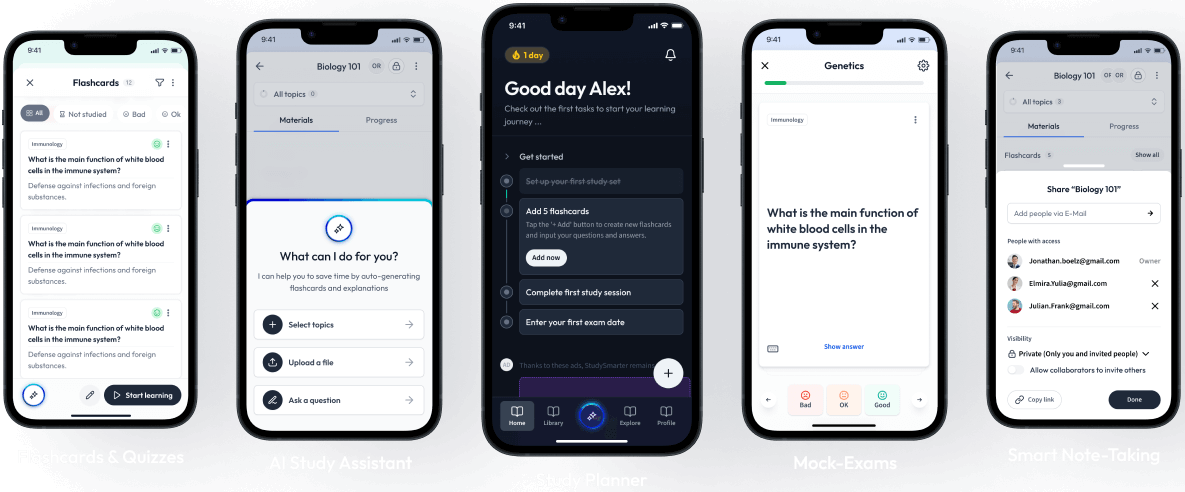

Study Techniques and Resources for Intermediate Accounting

For effective learning in Intermediate Accounting, couple your study plan with potent study techniques. One technique is the

Spaced Repetition in which you revise the topics at increasing intervals of time, enhancing long-term retention.

You can also utilise the

Feynman Technique where you explain a topic in your terms as if you're teaching it to someone else. This helps to reveal gaps in your understanding.

When grappling with complex problems, follow a consistent problem-solving method:

Identify what the problem is asking for.

Recognise the accounting principle involved.

Clear all conceptual doubts before proceeding.

Make attempts to solve the problem on your own.

Consult resources for solution only if you're stuck or want to verify the solution.

A wealth of resources is available for your preparation.

Textbooks provide comprehensive material, while

practice manuals offer domain-focused problems. Additionally,

online courses can provide concise, engaging content.

Common Mistakes to Avoid in Intermediate Accounting Examinations

Avoiding common mistakes can further boost your performance.

One crucial mistake is neglecting

conceptual clarity. Often, students try to memorise solutions or specific scenarios without understanding the underlying principle. This approach can backfire in examinations involving unique problems, as you would lack the ability to apply principles in unfamiliar situations.

Another common error is overlooking the

instructions. For example, the format of answers can significantly impact your scores. Some questions might require working notes for computations, while others might demand an explanation rather than a numerical solution.

Ignoring

time management is also hazardous during examinations. Spending too much time on difficult questions can potentially leave you with less time for other sections.

Lastly, a prevalent overlooked area is not staying updated with the latest

accounting standards. With the constant evolution in accounting practices, every change in laws or standards can directly reflect in your examination questions. Therefore, ensuring you have the latest information is critical to eliminate surprises on the examination day.

Intermediate Accounting - Key takeaways

- Intermediate Accounting: A field of accounting that involves in-depth application of accounting theory to realistic business scenarios. Some of the key elements you learn include the balance sheet, cash and receivables accounting, and deep analyses like understanding debt to equity ratios, inventory turnover rate, and accounts receivable turnover ratio.

- Value Impairment and Depreciation: These are concepts covered in intermediate accounting where even if a business asset like a machine gets damaged and can no longer render economic benefits, it is not declared worthless but evaluated for remaining value or alternative uses.

- Accrual Accounting and Matching Principle: Unlike basic accounting, intermediate accounting recognises costs like pensions in the period employees earn them, regardless of when they're paid. This aligns with the matching principle that expenses should be reported in the same period as the associated revenues.

- Revenue Recognition Principle: Intermediate accounting requires businesses to recognise revenue over the course of a software license contract and not immediately upon payment. This demonstrates how the field deals with complex business transactions.

- Balance Sheet in Intermediate Accounting: This is a snapshot of a company's financial condition, and preparing one involves making judgements, estimates, and assumptions. Intermediate accounting also teaches appreciation of the materiality concept where attention is focused on matters with substantial financial impact.

- Cash and Receivables in Intermediate Accounting: Understanding how to accurately present cash, cash equivalents and receivables on a company's balance sheet is crucial in intermediate accounting. This area also explores methods to account for uncollectible receivables, such as the direct write-off method and the allowance method.

- Passing Intermediate Accounting: This requires understanding precise accounting principles, staying updated with legislative changes, and applying theoretical knowledge to complex business scenarios. Strategies for successful learning include class attendance, practice, asking for help when needed, managing time effectively, and forming study groups.